When it comes to the workhorse of the beauty world, few products can hold a candle to face masks. For decades, masks have been a part of the lineup for nearly every skin care brand, but up until several years ago, the category seemed to be a bit stagnant. Not any longer. From mud to clay to cream to peel-off to sheet and reusable rubber versions, masks have been enjoying a renaissance.

Beauty consumers find masks add value to their regular beauty regimen, as reported from results of The Benchmarking Company’s June 2023 online study of 3,554 U.S. females. Seventy-three percent agree that using a facial skin care mask is a treat and an important part of "me time," 74% agree applying a mask feels like self-care, with 58% finding the experience of wearing facial masks relaxing.

Today we share fresh data to take a deeper look into her mask preferences, including ingredients of choice and brands she loves.

Most Popular Mask Brands & Price Points

Although not the most purchased skin care product (that honor goes to moisturizer), 60% of survey respondents have purchased a mask in the past six months.

For general brand awareness, the number one brand associated with face masks is Cetaphil (41%), followed by GlamGlow (38%), Drunk Elephant (37%), Kiehl’s (34%), SkinCeuticals/Bliss/First Aid Beauty (29%), Yes To (27%), Dr. Jart+/Freeman/Glow Recipe (25%), La Mer/Pacifica (24%), Tatcha (23%) and Patchology (22%).

Sixty-three percent of buyers told us they purchase sheet masks from mass brands (under $11 per mask), followed by more prestige brands such as Laura Mercier or Sol de Janeiro (54%). On average, the buyer doesn’t want to spend a lot of money for a sheet mask. In fact, 39% pay under $5 for sheet masks; 35% pay $5-10; and 15% pay $11-15.

Sheet Masks Dominate

With so many different types of facial masks available, it’s no surprise that consumers are reaching for a variety of different masks to meet their needs (T-1). Interestingly, sheet masks—which haven’t been around very long—have claimed the top spot as the most popular type of mask used over more traditional wash off clay or mud masks.

In fact, 56% agree that a sheet mask is an effective way to quickly deliver powerful ingredients to the skin, while 55% say they enjoy using a variety of different brands of sheet masks.

Overall, consumer awareness of sheet masks is increasing; 84% agree that compared to two years ago, more retailers are carrying sheet masks, and 83% say they use sheet masks regularly to boost their skin care routine. Sixty-five percent (65%) purchase/use sheet masks more than they did two years ago, and 54% expect that use to increase over the next two years.

Key Product Facets

Like other skin care categories, when making the decision to purchase a face mask, one of the most important aspects is efficacy or how well it works (94%, top two box of 5), followed by how it feels on the skin (86%), benefits listed on packing (81%), how quickly results are visible (78%), ingredients (75%), consumer claims/reviews (72%), price (61%), “is a brand I know/trust” (61%) and type of mask—mud, peel off, etc. (59%). Least important aspects? Packaging and look of the mask itself.

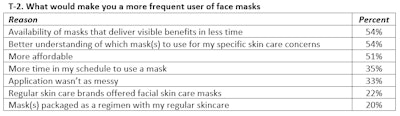

For consumers who don’t use masks regularly, addressing a few key issues would help them want to be a more frequent user of face masks, including delivering instant or more noticeable results in shorter timeframe; keeping them affordable; and less mess to apply or remove (T-2).

The majority of respondents report using a face mask as a regular part of their weekly skin care routine (37%) or an extra step when their skin needs special treatment (28%).Artem Varnitsin at Adobe Stock

The majority of respondents report using a face mask as a regular part of their weekly skin care routine (37%) or an extra step when their skin needs special treatment (28%).Artem Varnitsin at Adobe Stock

Mask-wearing Habits

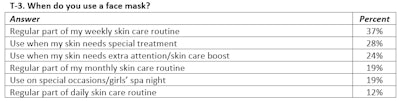

The majority of respondents report using a face mask as a regular part of their weekly skin care routine (T-3; 37%) or an extra step when their skin needs special treatment (28%). And although she’s using her mask weekly, she prefers using it to be convenient and speedy, with 52% preferring to wear a (non-sheet) mask between 10-20 minutes, and 20% saying 10 minutes or less is optimal.

Only 17% like to leave their face mask on for longer than 20 minutes. For sheet masks, 78% of consumers told us they prefer to leave them on for between six minutes and 20 minutes.

On a regular basis, 49% of consumers use between one and two masks, with 35% using three to four and 11% using five to six! For sheet masks, 61% of consumers report regularly using 1-2 different sheet masks, and 16% three to four different sheet masks.

Most Desired Benefits/Claims & Ingredients

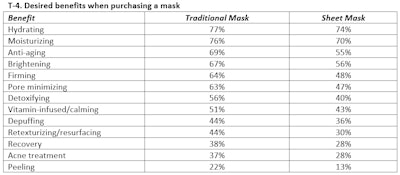

Ingredients that help hydrate, moisturize, and boost skin health and glow are the most sought after in a face mask, including hyaluronic acid, vitamin C and retinol (T-5). Other important ingredients include clay and charcoal, caffeine, honey and witch hazel.

Mask Retailer & Information Preferences

Consumers essentially expect every retailer will offer masks, with Ulta Beauty (74%), superstores like Target and Walmart (73%), Sephora (70%), Amazon (67%), brand websites (58%), and drugstores (58%) top of the list.

When she’s looking to buy a sheet mask, consumers expect to find information in stores (61%) and via free samples (61%). Online and social sources are also on her radar. Fifty percent expect to find information about masks online (Amazon or elsewhere), Instagram (44%), TikTok (37%), Facebook (34%), and their doctor or a dermatologist (25%).

Getting That First Mask Purchase

Based in sun-seared San Diego, DENISE HERICH is co-founder and managing partner at The Benchmarking Company (www.benchmarkingcompany.com). The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport, and consumer beauty product testing for marketing claims.